| Bank | Credit Name | Interest Rate | Minimum Term | Maximum Term |

|---|---|---|---|---|

| Konut Kredisi | % 0,82 | 1 yıl | 10 yıl | |

| Sabit Faizli Mortgage | % 0,91 | 1 yıl | 10 yıl | |

| Konut Finansmanı | % 0,75 | 1 yıl | 10 yıl | |

| Konut Finansmanı | % 0,88 | 1 yıl | 10 yıl | |

| Konut Kredisi | % 0,89 | 1 yıl | 10 yıl | |

| Kişiye Özel Mortgage | % 0,94 | 1 yıl | 10 yıl | |

| Standart Mortgage | % 0,73 | 1 yıl | 10 yıl | |

| Sabit Taksitli Mortgage | % 0,80 | 1 yıl | 10 yıl | |

| Konut Kredisi | % 0,82 | 1 yıl | 10 yıl | |

| İşbankası Ev Kredisi Mart Kampanyası | % 0,82 | 1 yıl | 10 yıl | |

| Kelepir mortgage | % 0,79 | 1 yıl | 10 yıl |

Housing Credit / Mortgage

Mortgage which is an English word means housing credit with long payment periods. Mortgage, the main method of house acquisition especially in U.S.A and Europe, enables parents to get credit for 20-30 years and become a homeowner. After a law was enacted in 2007 in Turkey, “mortgage” was appeared as an important source to become a homeowner.

Refinancing / Restructuring Credit

With the laws that have gone in effect recently, it was enabled an reorganisation under the names of refinancing / restructuring, as a result of credit loan, because of using whether housing credits or credit cards.

Housing Credit Calculation

By the housing credit calculation tool that ornekdaire.com offers you, you can compare housing credits all-in cost and demand credit by seeing real cost.

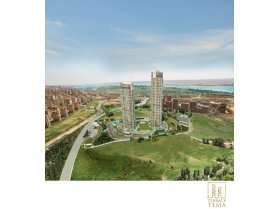

İnanlar İnş. AŞ

2012 yılında Zekeriyaköy'de başlayacak proje, bahçeli, doğayla iç içe ve müstakil evler olarak planlanmıştır.

İnanlar İnş. AŞ

2012 yılında Zekeriyaköy'de başlaması planlanan Terrace Doğa; doğayla iç içe yaşamak isteyenler için..

E-Newsletter Subscription |

|

You can easily keep track of new postings by participating in e-mail list. |

|

Share